2024 U.S. Presidential Election

With the United States presidential election less than four months away, we felt it worthwhile to share comments from our investment managers on the possible impact on global financial markets.

The 2024 presidential race has already seen its share of dramatic events, including the former president and Republican candidate Donald Trump navigate ongoing legal issues, and more recently, survive an assassination attempt. On the opposing side, President Joe Biden made the decision to step-down from the race over concerns for his health and ability to effectively serve as commander-in-chief at the age of 81. Biden removing himself from the ballot this late in the election is unprecedented. The last standing president to not seek a second term was Lyndon B. Johnson in 1968, announcing his decision in March of the election year. The leading Democratic candidate is now Vice President Kamala Harris. Harris has gathered key endorsements from leaders in her party and Democratic delegates to support her as the presumptive nominee. The official Democratic candidate is expected to be announced before the start of the Democratic National Convention on August 19th.

As of the end of July, prediction markets and certain political pundits have the odds of a Trump victory at just under 60%, down from the previous high of 70% following the assassination attempt and troublesome performance by Biden in the first presidential debate. Following Biden’s decision to step down, financial markets have not materially changed, which suggests markets expect policies from the future Democratic candidate will be aligned with Biden. Equities and other risk assets that are perceived to benefit from a Republican candidate have moved higher in the short term, including likely beneficiaries of potential lower taxes, less regulation, and a stronger U.S. dollar. There is uncertainty on the ultimate outcome of the election, but it is fair for investors to question and reasonably speculate how sectors, industries, as well as currencies and commodities will perform under one president versus the other. Historical market data provides a

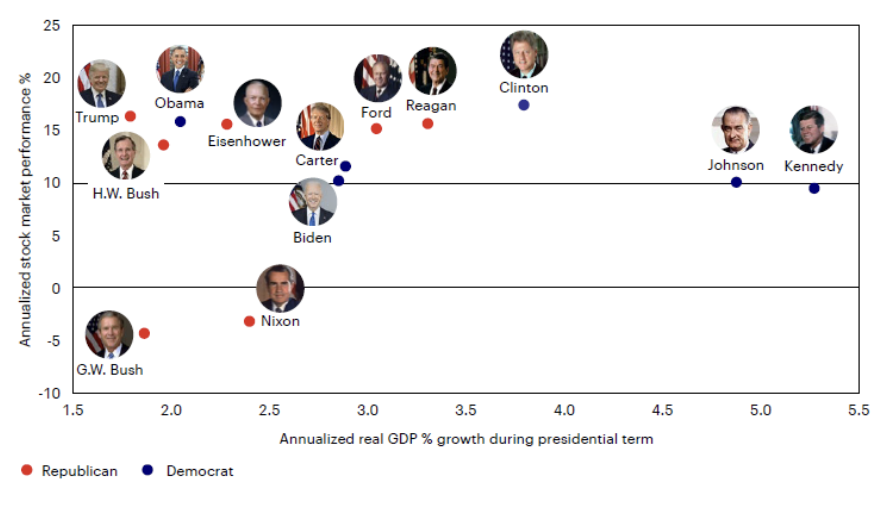

nuanced answer, supporting the notion that investors tend to overstate the implications the residing president has on financial markets. Since 1957, domestic equity markets have generally performed well under both Republican and Democratic presidents. There have only been two presidencies where domestic equites generated a negative return during the respective terms, with both happening to end in deep recessions (George W. Bush and Richard Nixon).

Stock Market Returns vs. Economic Growth During Presidential Terms (1957-Present) 1

Market performance and the health of the economy are not perfectly correlated. Data has shown favorable monetary policies from the Fed and the level of market valuations when a president takes office have played a meaningful role in equity market returns during a president’s term. This is highlighted by the similarity of domestic equity market performance during the Ronald Reagan (1/20/1981 – 1/20/1989) and Barack Obama (1/20/2009 – 1/20/2017) presidencies. While domestic policies under Reagan and Obama reflected widely different approaches shaped by their respective political ideologies, they both started their terms in a recession and at a time when market valuations were historically low. In addition, there was favorable monetary policy by the Fed during both presidents’ tenure designed to stimulate the economy. The cumulative price return for the S&P 500 was +207% and +234% for Reagan and Obama, respectively, during the 8-years they served as president.

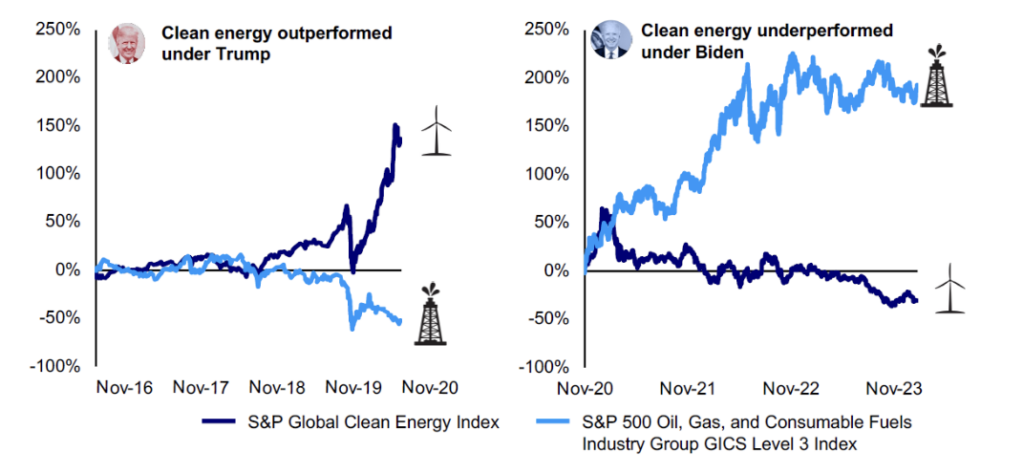

Picking sectors believed to benefit from a president’s policy agenda is also a complicated endeavor. Trump’s energy policy during his first term (2016-2020) focused on promoting domestic energy production by reducing regulations on the fossil fuel industry and withdrawing from the international Paris Agreement on climate change. In contrast, Biden’s energy policies from November 2020 through today have focused on tightening emissions standards and supporting clean energy initiatives. When looking at the performance of the S&P Clean Energy and Fossil Fuel indices 2, the Clean Energy Index outperformed the Fossil Fuels Index during the Trump presidency and has underperformed during Biden’s term – a surprising outcome if looking solely at the policies of either president. This comparison highlights the due diligence required by investment managers when analyzing the impact of public policy on sectors and specific companies.

Sector Performance Based on the President’s Policy Does Not Always Go as Expected Clean Energy vs. Fossil Fuels Public Equity Performance under Trump and Biden 2

Looking ahead to the 2024 election, an important consideration when analyzing the potential impact of a president’s agenda on financial markets is which party controls Congress. More legislation tends to get passed when a single party is in power, whereas a split government will likely mean limited legislative action. Currently, the government is split with the Democratics narrowly controlling the Senate and Republicans controlling the House of Representatives. If Trump were to win the election and the Republican party wins control of both branches of Congress, it is expected more of his nominees will be approved and legislation will be passed. If Congress remains split, it is believed more partisan policy would have to come from the standing president’s executive orders. Prediction markets and political polling currently imply a tight race, favoring either a divided outcome or a Republican sweep at 45% and 35% odds, respectively. Examples of certain policies and the expected impact should a political party win both the presidential election and control Congress includes the following:

• Taxes: Several provisions in the Tax Cuts and Jobs Act of 2017 are scheduled to expire at the end of 2025. With a Trump victory, it is expected many of the provisions will be extended. This includes corporate and individual tax rates, as well as maintaining the increased levels of tax-free limits on gifts and estate tax exemptions. A Democratic victory is expected to retain tax cuts for individuals making less than $400,000 but increase the tax top tax rate from 37% to 39.6%.

• Immigration: More aggressive controls expected from Republicans with a Trump victory, while a continuation of Biden’s policies is expected with a Democratic victory. Automatic citizenship for children of undocumented immigrants born in the U.S. is expected to be maintained with a Democratic victory and removed if a Republican victory.

• Trade: Both parties have maintained or raised tariffs; however, a Trump victory and Republican control could mean additional tariffs for certain industries, including steel and aluminum.

• Energy: Energy production has increased regardless of the controlling political party; however, a Democratic victory is expected to continue the implementation of Inflation Reduction Act and green energy initiatives. A Trump and Republican victory is expected to pullback regulations in the fossil fuel industry and remove certain incentive packages for green energy.

• Monetary policy: The independence of the Fed from the Executive Branch is designed to avoid political pressure on monetary policy decisions; however, the Fed Chairman is appointed by the president. It is generally expected a Democratic president would reappoint Fed Chairman Jerome Powell, while there is uncertainty if Trump would do the same when Powell’s term expires in 2026. Trump has shown a non-traditional approach of applying pressure on the Fed to lower interest rates.

The potential impact of policy on asset classes and industries is closely followed by investment managers. When looking at areas of possible bipartisan support and/or likely outcomes regardless of who wins the election, the market and certain Prairie Capital investment managers have noted the following:

• U.S. Manufacturing: The onshoring trend, or shift of manufacturing back to the United States, is expected to continue. The COVID-19 pandemic and geopolitical issues have highlighted the risk of supply chains dependent on foreign locations. The trend of shifting manufacturing back to the United States has already begun and is supported by the Infrastructure Investment and Jobs Act, Inflation Reduction Act, and the CHIPS and Science Act passed under Biden’s presidency. Trump’s “America First” agenda and increased infrastructure on the company’s borders would also likely be supportive.

• Global Defense Spending: Defense spending by member countries of the North Atlantic Treaty Organization (“NATO”) has steadily increased, reversing the previous trend of declining spending since the fall of the Berlin Wall in 1989. Twenty-three members of NATO are expected to meet the 2%-of-GDP military spending commitment in 2024, up from 11 in 2023 and just three in 2014.3 The close proximity of wars in Ukraine and Israel have supported the increased defense spending in Europe. In addition, there is bipartisan support in the U.S. to invest in technologies and other areas to counter China influence.

• Inflation: Onshoring trends, tariffs, and additional government spending initiatives are inflationary, and could potentially lead to higher inflation in the intermediate term. Should the Fed decide to cut interest rates in the short term, it could also support higher inflation.

As always, we welcome the opportunity to discuss this report and your portfolio in detail. We appreciate the trust and confidence that you have placed in Prairie Capital. We look forward to connecting throughout the course of the year.

Sincerely,

Prairie Capital Management Group, LLC

Important Disclosures

Past performance is not an indication of future results. This publication does not constitute, and should not be construed to constitute, an offer to sell, or a solicitation of any offer to buy, any particular security, strategy, or investment product. This publication does not consider your particular investment objectives, financial situation, or needs, should not be construed as legal, tax, financial or other advice, and is not to be relied upon in making an investment or other decision.

Certain information contained herein has been obtained or derived from unaffiliated third-party sources and, while Prairie Capital Management Group, LLC (“Prairie Capital”) believes this information to be reliable, makes no representation or warranty, express or implied, as to the accuracy, timeliness, sequence, adequacy, or completeness of the information. The information contained herein, and the opinions expressed herein, are those of Prairie Capital as of the date of writing, are subject to change due to market conditions and without notice and have not been approved or verified by the United States Securities and Exchange Commission (the “SEC”), the Financial Industry Regulatory Authority (“FINRA”), or by any state securities authority. This publication is not intended for redistribution or public use without Prairie Capital’s express written consent.

1 Source: Invesco “U.S. Presidential Election 2024: Policy Platforms and Implications for Investors.” President Biden’s stock performance data is from 1/20/21 through 1/31/24. President Eisenhower’s second term is only shown. Real GDP data is from 12/31/2016 – 12/31/2023. Stock market performance is defined by the S&P 500 Index Total Return. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic stocks. Past performance does not guarantee future results.

2 Source: Invesco “U.S. Presidential Election 2024: Policy Platforms and Implications for Investors.” The S&P Global Clean Energy Index is designed to measure the performance of companies in global clean energy-related businesses from both developed and emerging markets, with a target constituent count of 100. The S&P 500 Oil, Gas, and Consumable Fuels Index is a GICS level 3 index, representing the oil, gas, and consumable fuels industries within the S&P 500 Energy sector. An investment cannot be made in an index. Past performance does not guarantee future results. 3 Source: Invesco “U.S. Presidential Election 2024: Policy Platforms and Implications for Investors.” 2024 Outlook by the Eurasia Group, March 2024.