Third Quarter 2024 Market Update

“Over the last year, we believe anticipation of rate cuts has created far more stock

market value than what actual rate cuts will contribute to capital markets.” –

Long/Short Hedge Fund Manager

Third Quarter 2024 Market Update

The third quarter delivered another period of solid returns across capital markets, although volatility spiked at several points. August, in particular, was marked by significant volatility as major indices sold off due to concerns over softening economic data and a surprise interest rate hike by the Bank of Japan, which triggered the unwinding of a popular Japanese Yen carry trade. Despite these events, equity markets recovered and finished the quarter with positive returns, once again nearing all-time highs.

The U.S. Federal Reserve (the “Fed”) lowered interest rates for the first time in four years with a 50-basis point (0.50%) rate cut in September. Markets reacted positively as the prospect of a “soft landing” economic scenario became more likely. Market breadth also improved significantly over the quarter, which was a welcome sign for investors and a notable shift from previous periods where performance was concentrated among a small number of mega-cap technology names. In fact, since mid-July (when the Nasdaq 100 and the “Magnificent Seven” peaked), nearly three-quarters of all stocks in the S&P 500 have outperformed the index itself.

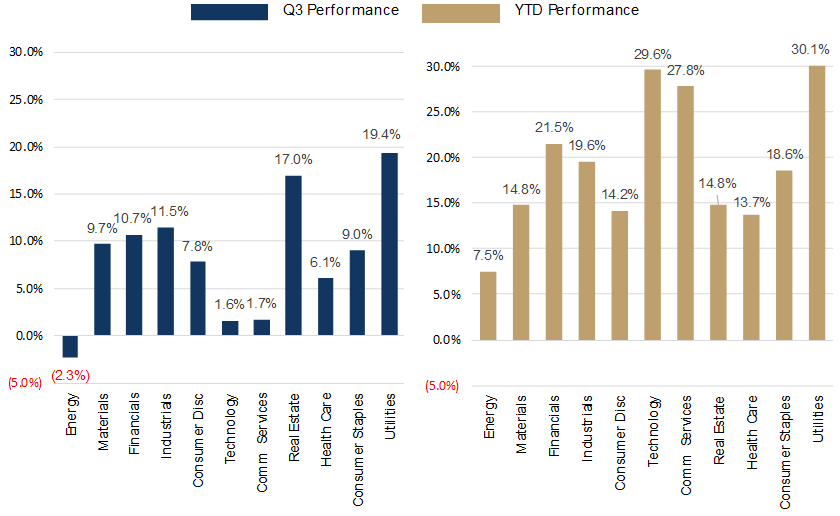

Domestic equity markets, as measured by the S&P 500 Index, gained +5.9% during the third quarter and are up +22.1% year-to-date (“YTD”), marking one of the best years through the first three quarters in decades. The third quarter also saw several shifts in market leadership from both a sector and style perspective. Specifically, interest rate-sensitive sectors including utilities (+19.4%, +30.1% YTD), real estate (+17.0%, +14.8% YTD), and industrials (+11.5%, +19.6% YTD) were the best performing sectors over the period. Energy continued to struggle (-2.3%, +7.5% YTD), while the best performing sectors from the second quarter, technology (+1.6%, +29.6% YTD) and communication services (+1.7%, +27.8% YTD), significantly lagged the broader market. Style leadership also reversed during the third quarter, with value stocks significantly outperforming growth stocks across all market capitalizations. The largest spread occurred among domestic large-cap stocks, where value outperformed growth by more than 600 basis points, as measured by their respective Russell 1000 benchmark indices. Broadly speaking, small- and mid-cap stocks outperformed their large-cap peers during the quarter in anticipation of lower rates, though they still lagged on a YTD basis.

Outside of the U.S., developed international markets posted positive gains of +7.3% for the quarter, as measured by the MSCI EAFE Index. Year-to-date, the MSCI EAFE Index is up +13.0%, with global central bank policy remaining a significant driver of market performance. European stocks posted gains as investors continued to expect further interest rate cuts from the European Central Bank, following two reductions earlier this year. Japanese equity markets were notably volatile, dropping more than 12% in a single day in early August after the Bank of Japan announced a surprise hawkish rate hike. Emerging market equities outperformed developed international markets during the period, returning +8.7% for the quarter (+16.9% YTD), as measured by the MSCI Emerging Markets Index. Chinese equities climbed throughout the quarter, as investors reacted positively to the government’s continued stimulative efforts to boost the economy, including interest rate cuts and pledges to stabilize real estate assets.

Lower interest rates propelled fixed income markets to positive returns for the quarter, with the Bloomberg U.S. Aggregate Index gaining +5.2%, turning positive for the year (+4.5% YTD). After being inverted since mid-2022—meaning yields on shorter-duration bonds were higher than those on longer-duration bonds—the U.S. Treasury yield curve (2-year vs. 10-year) flipped back to a positive slope during the period. Longer-dated bonds performed well as rates declined, with the 10-year U.S. Treasury yield finishing the third quarter at 3.8%, down from 4.4% at the previous quarter’s end. In credit markets, investment-grade bonds returned +5.8%, and high-yield bonds gained +5.3%, both measured by their respective Bloomberg indices. Municipal bonds, mortgage- and asset-backed securities, and convertibles also posted positive returns during the quarter. The U.S. dollar weakened against most major currencies (e.g., Euro, Yen), falling -4.8% for the quarter, as measured by the U.S. Dollar Index. Commodity returns were mixed, with gold notably rallying to near all-time highs, posting its largest quarterly gain since 2016 (+12.9%) as faster rate cuts were priced in, ending the quarter above $2,600 per ounce. Oil prices, however, were down double digits, as expectations for higher global production weighed on the market.

S&P 500 Sector Performance

Interest rate sensitive sectors led performance in Q3, while AI themes have supported strong returns in the technology and communication services sectors YTD.

A Turning Point in Federal Reserve Policy

“The Fed’s recent rate cut may sow the seeds for a cyclical recovery, but whether it arrives in time to avoid an economic downturn is uncertain. Further, interest rates are likely to settle higher than the ultra-low levels of the past 15 years.” – Domestic Equity Manager

At its recent September meeting, the Fed initiated its first, and widely expected, interest rate cut, reducing the Fed Funds Rate by 50 basis points (0.50%) to a target range of 4.75-5.00%. Expectations had been mixed regarding whether the initial cut would be 25 or 50 basis points. However, the Fed demonstrated its willingness to react to an evolving market landscape with a front-loaded 50 basis point cut. The Fed’s most recent “dot plot,” a graph summarizing the committee members’ rate projections, revealed that the decision was far from unanimous, as nine members did not support a 50 basis point cut this year. Nonetheless, Chairman Powell’s press conference, the economic projections, and the decision itself underscored the Fed’s focus on its “dual mandate” of pursuing maximum employment and price stability, shifting away from its earlier, narrower focus on taming inflation. Most economists now anticipate a series of smaller 25 basis point cuts between now and mid-to-late 2025.

A closer look at the underlying economic data suggests that economic growth remains positive, with the most recently revised second quarter estimates showing GDP growth at an annual rate of +3.0%. However, other indicators suggest that growth is slowing, a trend that is expected to continue. Data now indicates that the post-pandemic strain of decades-high pricing pressures is easing. Apart from a few areas, such as housing and insurance, prices have significantly eased across most categories. While rate cuts could potentially put some upward pressure on demand and prices, economists expect inflation to continue trending down toward longer-term targets.

With inflation-related risks notably receding, the Fed appears to have shifted its focus to economic growth and employment. While the labor market remains strong, it is undeniable that signs of cooling are emerging. Recent data highlights this moderation, with payroll numbers slowing and job openings decreasing. Over the past quarter, the average payroll gain was 116,000, compared to 267,000 in the first quarter and 147,000 in the second quarter. However, wages continue to rise at a healthy pace, outpacing inflation, and the unemployment rate remains near 4%.

Final Thoughts

“Despite all the valuation frothiness, market participants are undoubtedly twitchy. It’s, after all, a twitchy time in the United States as we hurtle towards another close and hotly contested election. One way to understand this is that nearly 60% of Americans tell pollsters that things have never been worse, despite a generally strong economy that includes wage growth in real terms across every income cohort.“ – Private Credit Manager

By almost any measure, this year’s market performance has been remarkable. As we reflect on this, several reasons for optimism persist. Inflation continues to ease, trending towards more normalized levels, corporate profits remain robust, and consumer spending is still healthy. As the Fed enters the next phase of its policy cycle, lower interest rates should further support the economy. Although the Fed does not have a strong track record of successfully navigating economic “soft landings,” the recent rate cut has boosted optimism that one may be achievable this time. On the other hand, there are (and always will be) risks worth monitoring closely. For one, equity markets remain highly concentrated in a small group of mega-cap companies, and the performance of these few firms heavily influences market index returns. Valuations for this cohort remain elevated compared to historical averages. Additionally, consumer health bears close watching. The higher borrowing costs that helped tame inflation are also affecting consumers, as evidenced by elevated delinquency rates on credit cards, auto loans, and other forms of debt.

Last but certainly not least, market participants are keeping a close eye on the upcoming election cycle. Recent polling data suggests a close race, both at the presidential level and in Congressional races. Whichever candidate emerges victorious in November will be crucial, given their decidedly different policy agendas. These differences could have significant economic and financial implications. Election years often bring about market volatility, and we expect this to continue over the coming months. As events unfold, we will closely monitor policy developments that could impact the economy and investor behavior.

Given the uncertainties in today’s markets, we continue to advocate for a diversified approach to portfolio construction. In years like this, rebalancing should be a key focus for investors to ensure that asset allocations remain aligned with long-term objectives and that risks are carefully monitored. A diversified approach, built on high-quality investment strategies, positions portfolios for a range of potential outcomes, with the goal of achieving strong risk-adjusted returns over market cycles.

As always, we welcome the opportunity to discuss your portfolio in detail and appreciate the trust and confidence that you have placed in Prairie Capital. We look forward to connecting with you soon.

Important Disclosures

Past performance is not an indication of future results. This publication does not constitute, and should not be construed to constitute, an offer to sell, or a solicitation of any offer to buy, any particular security, strategy, or investment product. This publication does not consider your particular investment objectives, financial situation, or needs, should not be construed as legal, tax, financial or other advice, and is not to be relied upon in making an investment or other decision.

Certain information contained herein has been obtained or derived from unaffiliated third-party sources and, while Prairie Capital Management Group, LLC (“Prairie Capital”) believes this information to be reliable, makes no representation or warranty, express or implied, as to the accuracy, timeliness, sequence, adequacy, or completeness of the information. The information contained herein, and the opinions expressed herein, are those of Prairie Capital as of the date of writing, are subject to change due to market conditions and without notice and have not been approved or verified by the United States Securities and Exchange Commission (the “SEC”), the Financial Industry Regulatory Authority (“FINRA”), or by any state securities authority. This publication is not intended for redistribution or public use without Prairie Capital’s express written consent.