Tax Planning: Annual Gift Exclusions & Retirement Contribution Limits

As we transition from 2024 into the new year, we want to highlight important information for tax planning, including annual gift exclusions and retirement contribution limits. Retirement contributions can still be made until April 15th, allowing you to take full advantage of benefits for the 2024 tax year.

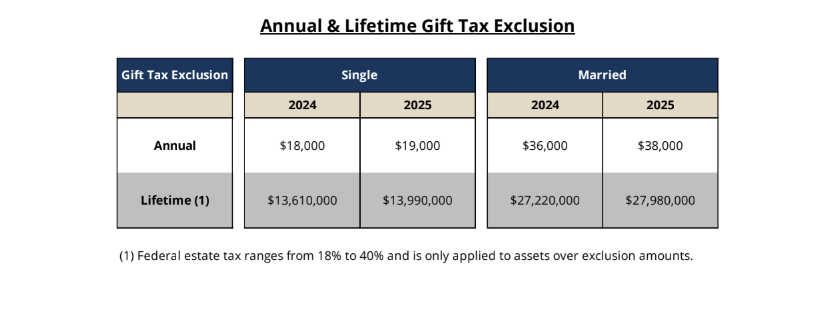

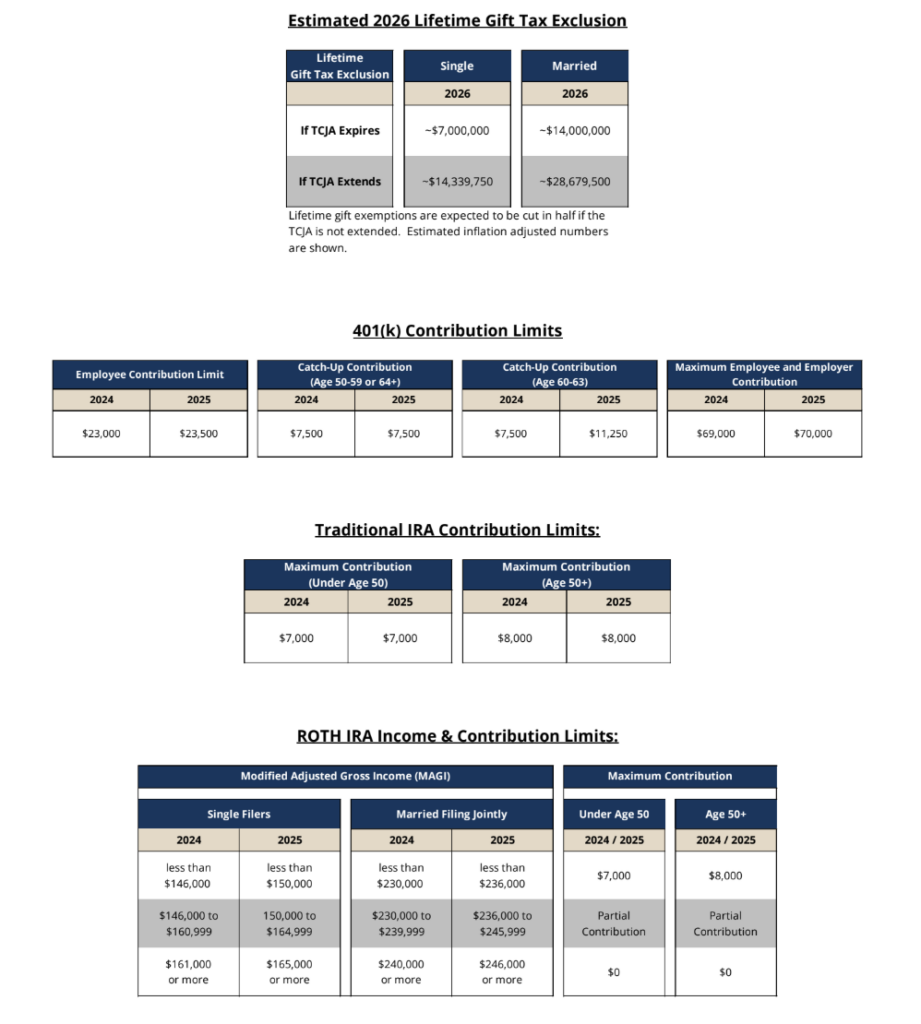

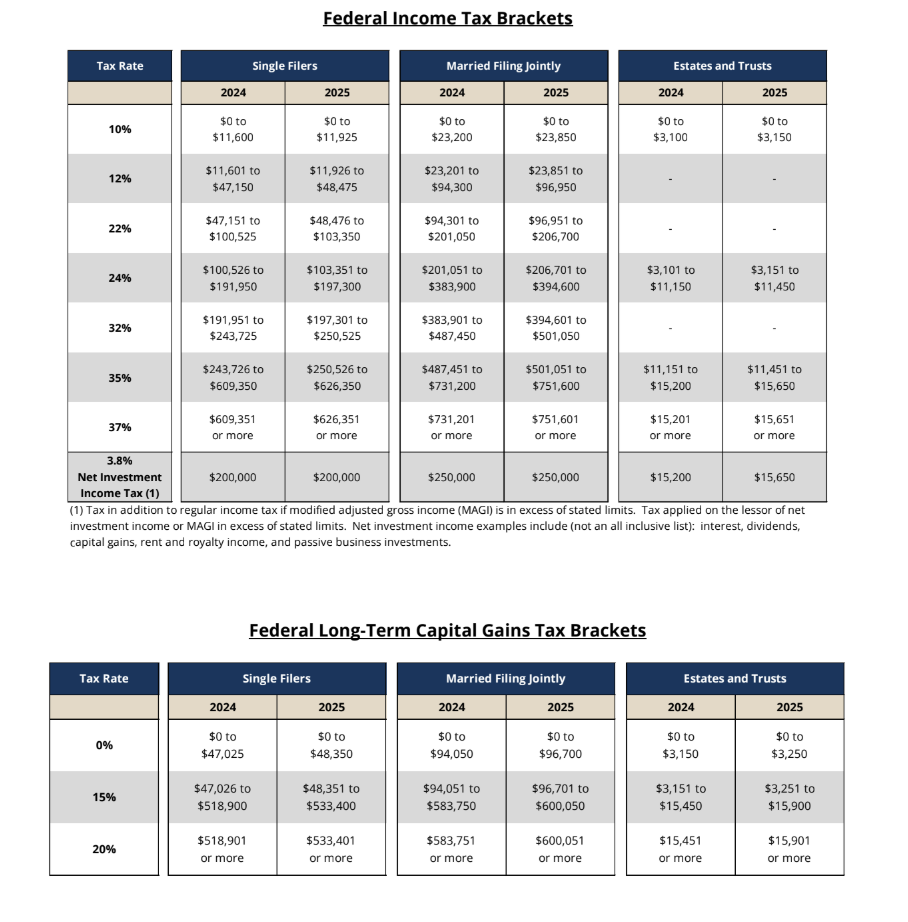

In addition, the Internal Revenue Service announced annual inflation adjustments for tax year 2025, effectively increasing retirement account contribution limits and tax-free limits on gifts and estate tax exemptions. Income thresholds for tax brackets have also been adjusted higher. Details are provided in the charts included in this report.

Beyond 2025, there is the potential for significant U.S. tax changes as several provisions in the Tax Cuts and Jobs Act of 2017 (“TCJA”) are scheduled to expire at year-end. With the recent election of President Donald Trump and a Republican majority in Congress, it is expected many of the provisions will be extended and/or modified. However, should Congress not act to extend these provisions, individual income tax rates are projected to increase, and the lifetime gift tax exclusion amount, which nearly doubled in 2017, is expected to revert to pre-TCJA levels. We will continue to monitor legislative developments throughout 2025.

As always, we welcome the opportunity to discuss this report and your portfolio in detail. We appreciate the trust and confidence that you have placed in Prairie Capital. We look forward to connecting throughout the course of the year.

Sincerely,

Prairie Capital Management Group, LLC

Please note the information provided does not, and is not intended to, constitute tax advice. All information is for general informational purposes only.

Important Disclosures

Past performance is not an indication of future results. This publication does not constitute, and should not be construed to constitute, an offer to sell, or a solicitation of any offer to buy, any particular security, strategy, or investment product. This publication does not consider your particular investment objectives, financial situation, or needs, should not be construed as legal, tax, financial or other advice, and is not to be relied upon in making an investment or other decision.

Certain information contained herein has been obtained or derived from unaffiliated third-party sources and, while Prairie Capital Management Group, LLC (“Prairie Capital”) believes this information to be reliable, makes no representation or warranty, express or implied, as to the accuracy, timeliness, sequence, adequacy, or completeness of the information. The information contained herein, and the opinions expressed herein, are those of Prairie Capital as of the date of writing, are subject to change due to market conditions and without notice and have not been approved or verified by the United States Securities and Exchange Commission (the “SEC”), the Financial Industry Regulatory Authority (“FINRA”), or by any state securities authority. This publication is not intended for redistribution or public use without Prairie Capital’s express written consent.