Tax Planning: Annual Gift Exclusions & Retirement Contribution Limits

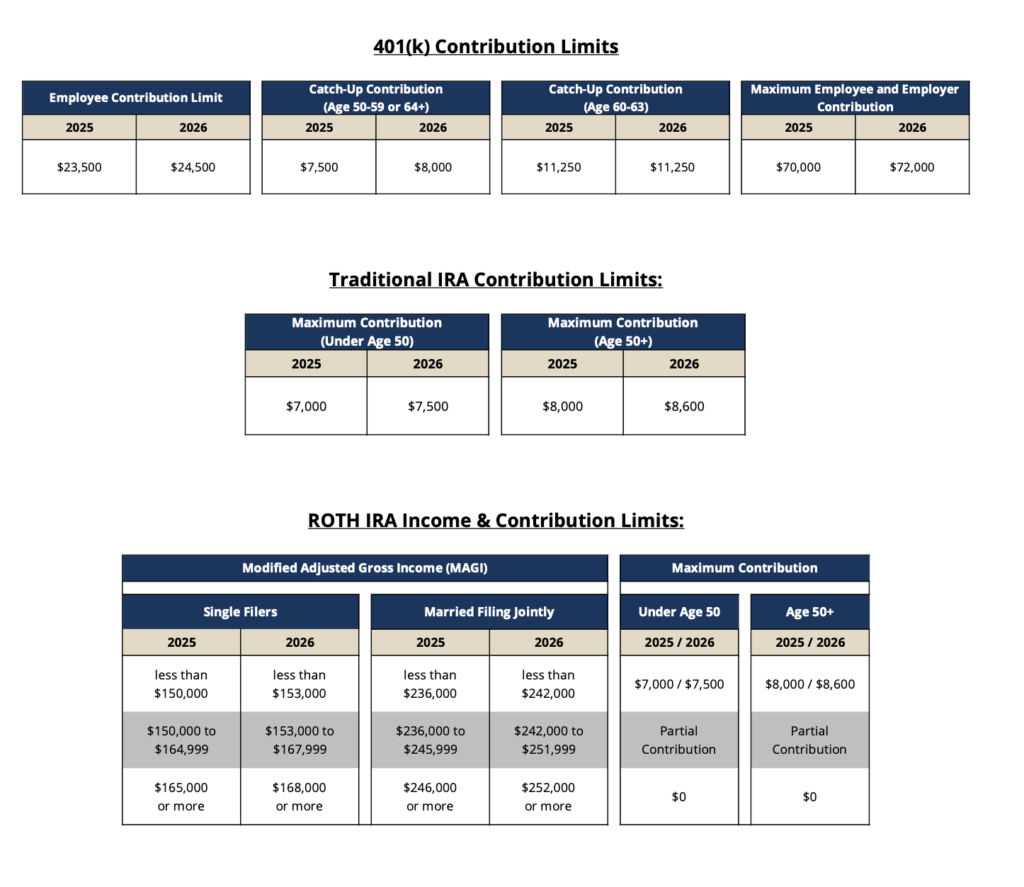

As we transition from 2025 into the new year, we want to highlight important information for tax planning, including annual gift exclusions and retirement contribution limits. Traditional and ROTH IRA contributions for the 2025 tax year can still be made until April 15, 2026, allowing you to maximize available benefits.

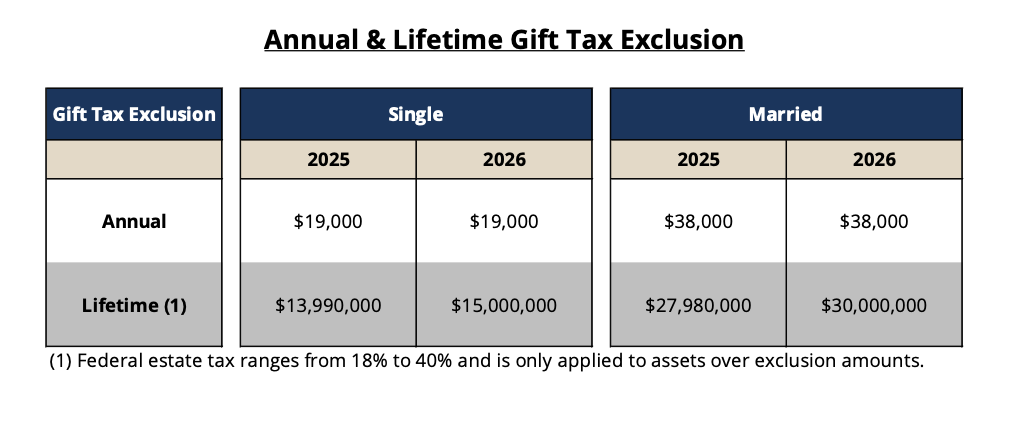

The Internal Revenue Service has announced annual inflation adjustments for tax year 2026, increasing retirement account contribution limits and estate tax exemptions. Income thresholds for tax brackets have also been adjusted higher. Details are provided in the charts included in this report.

Beyond 2026, individual tax planning will require careful attention as the landscape continues to evolve. The One Big Beautiful Bill has made several key provisions permanent for the Tax Cuts and Jobs Act, providing greater long-term certainty for taxpayers. These include maintaining the current income tax brackets, preserving the higher standard deduction, and continuing to expand the lifetime estate and gift tax exemption. With these measures now permanent, individuals should focus on strategies that maximize these benefits, such as timing income and deductions, planning charitable contributions, and utilizing gifting opportunities to reduce future estate tax exposure. Proactive planning will be essential to minimize tax liability and take full advantage of these favorable provisions. We will continue to monitor legislative developments throughout 2026.

As always, we welcome the opportunity to discuss this report and your portfolio in detail. We appreciate the trust and confidence that you have placed in Prairie Capital. We look forward to connecting throughout the course of the year.

Sincerely,

Prairie Capital Management Group, LLC

Please note the information provided does not, and is not intended to, constitute tax advice. All information is for general informational purposes only. Please consult with your qualified tax advisor regarding your personal situation.

Important Disclosures

Certain information contained herein has been obtained or derived from unaffiliated third-party sources and, while Prairie Capital Management Group, LLC (“Prairie Capital”) believes this information to be reliable, makes no representation or warranty, express or implied, as to the accuracy, timeliness, sequence, adequacy, or completeness of the information. The information contained herein, and the opinions expressed herein, are those of Prairie Capital as of the date of writing, are subject to change due to market conditions and without notice and have not been approved or verified by the United States Securities and Exchange Commission (the “SEC”), the Financial Industry Regulatory Authority (“FINRA”), or by any state securities authority. This publication is not intended for redistribution or public use without Prairie Capital’s express written consent.